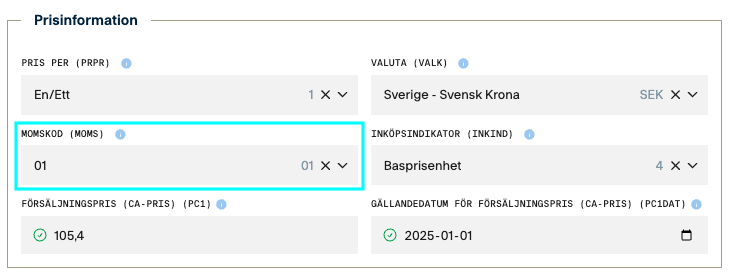

Field codes IN KNMOMS | OUT WIMOMS | API vatCode

Definition

This field specifies which VAT code applies to the item when sold to the end customer.

The Swedish Tax Agency (Skatteverket) continuously updates VAT regulations. For the latest information on VAT rates, always visit Skatteverket’s website.

Explanation

The VAT rate is defined through a VAT code and determines which value-added tax should be applied at the time of sale. VAT regulations are continuously updated by the Swedish Tax Agency (Skatteverket), which is why it is important to always verify the current information there.

Table updated 2025-10-03.

|

VAT code |

Description |

Details |

|---|---|---|

|

01 |

Standard |

25% VAT

|

|

02 |

Food |

12% VAT

25% VAT applies (use code 01) for:

25% VAT also applies to the following, which are not considered food:

|

|

03 |

Newspapers & Books |

6% VAT applies to:

If the above products primarily consist of advertising, 25% VAT must be applied instead.

|

|

04 |

VAT exempt |

|

Temporary VAT reduction on food

From April 1, 2026, to December 31, 2027, the VAT rate on food will temporarily be reduced from 12% to 6%. This reduction is part of the government’s food price relief package aimed at supporting households affected by rising food costs. The reduction applies to all food products, meaning the 12% rate for code 02 is valid only until April 1, 2026.

Usage

The supplier specifies the VAT code for the item. To ensure that the trade applies the correct VAT rate, this field should always be completed.

Finfo verifies that only valid VAT codes according to the standard are used.

Recipients use the information to apply the correct VAT rate when selling to the end customer.